Importance of filing Income Tax Return (ITR)

ITR for FY 2019-20 (AY 2020-21) Due Date is 30th November.

Importance of filing income tax return

An income tax return is a legal document that stands as your proof of income. Even if you are...

Income Tax Benefits on Home Loan

1. Section 80C: Deduction up to Rs 1.5 lakh on home loan principal repayment.

2. Section 24b: Deduction up to Rs 2 lakh on interest repaid during pre and post construction period.

3. Section 80EEA: Additional...

ITR related Provisions

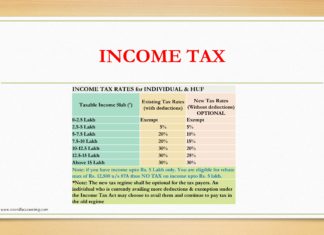

1) Who all need to file their tax returns?

If your gross total income (excluding deductions) exceeds the basic exemption limit of income above which tax is charged, you need to file ITR.

People spending over ₹2...

CBIC further extends the due date for filing Form GSTR 4 for the FY...

As per the recent tweet of the Central Board of Indirect Taxes and Customs (CBIC), the Last date for filing Form GSTR 4 for the FY 2019-20 has been extended to October 31, 2020.

Source:...

Aadhar Authentication Mandatory for GST Registration w.e.f. August 21, 2020

Notification No. 62/2020 – Central Tax dated August 20, 2020 being issued to bring in change in GST Registration Procedure.

The CBIC vide Notification No. 62/2020 – Central Tax dated August 20, 2020 has made certain amendments in...

Transparent Taxation

Prime Minister Shri Narendra Modi has launched the platform for ‘Transparent Taxation’ on 13th August 2020 to ease compliance and benefit for taxpayers.

Key Highlights

Faceless assessment, Faceless appeal. Faceless appeal will be applicable from 25th...

Is it mandatory to disclose all Bank Accounts in ‘ITR’ ?

- Yes

- It is mandatory to list all bank accounts in the ITR form.

- it is mandatory to report all your bank accounts except the dormant ones. ... These are- name of the bank, account number and IFSC code....

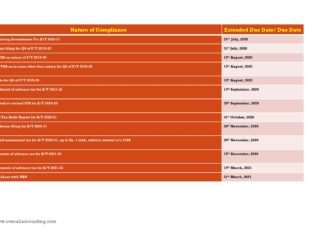

Updated Due Date Chart of Income Tax Compliance

Due to COVID-19 pandemic and challenges faced by taxpayers, The Government has extended due dates of Direct Taxes.

Chart of Due dates/Extended due dates under Income Tax Act, 1961

Nature of Compliance

...

Income Tax Return Due Date Extend for FY 2018-19

Due to the Covid pandemic & to further ease compliances for taxpayers, CBDT extends the due dt for filing of Income Tax Returns for FY 2018-19(AY 2019-20) from 31st July, 2020 to 30th September,...