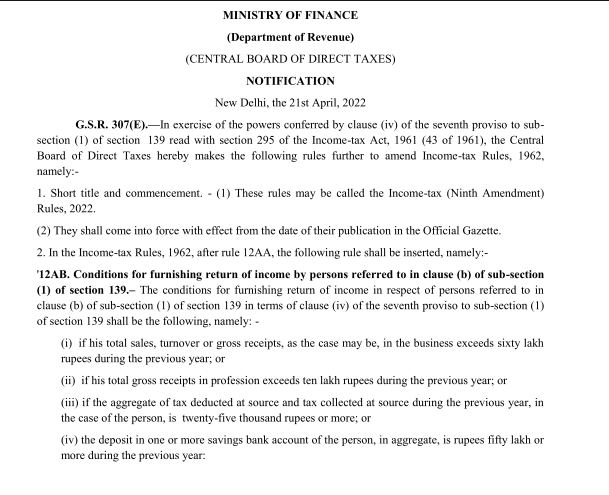

On 21st April Central Board of Direct Tax (CBDT) issued https://www.incometaxindia.gov.in/communications/notification/notification-37-2022.pdf through which Central Government (CG) has introduce Rule 12AB, the Income Tax Rules, 1962 regarding some new conditions for furnishing the Income Tax Return (ITR) in respect of persons other than a company or firm.

New IT Rule 12AB now mandates Compulsory Return Filing in all cases where limits in last FY exceeded for:

– If Business Turnover (sales or gross receipts) Rs. 60 lacs,

– Professional Receipts Rs. 10 lacs,

– TDS & TCS Rs.25,000 (Rs. 50,000 if age is sixty or more) and

– Credits in one or more SB A/cs Rs. 50 lacs

If any person falls in any of the category mentioned above then he /she is mandatorily liable to file his/her Income Tax Return (ITR).

** What if not filed the Return?

1). For salaried person

Any tax in paying income tax will lead to spending a compensatory sum of Rs.10,000. However, if you file your ITR after 31st August and before 31st December, a penalty of Rs.5000 will be levied.

However, if your income does not exceed Rs.5 lakhs, Rs.1000 will be levied for the delay.

2). For self-employed

– The rule for self-employed people is the same as above. Rs.10,000 is paid as a penalty in case of general late payment, and if you have filed the ITR after 31st August but before 31st December, you have to pay a fine of Rs.5000.

And, in the case your income does not exceed Rs.5 lakhs, you need to pay Rs.1000.

3). For companies

The rule for late payment of ITR is the same for companies as well. The penalty will be Rs.10,000, but if the income is less than Rs.5 lakhs, you need to pay a fine of Rs.1000.

4). For senior citizens

Senior citizens will also need to pay a late fine of Rs.10,000 if they fail to declare their ITR by the due date, and if their income is less than Rs.5 lakhs, a fine of Rs.1000 will be imposed.

** The taxpayer would also be subjected to interest under section 234A at 1% per month or part of the month for any amount of tax remaining unpaid.

** The taxpayer would not be allowed to claim the benefit of certain deductions and/or set off and carry forward of losses other than loss from house property loss, due to non-filing of the tax return within the prescribed due dates.

** In case of non-filing of tax return, income tax authorities will hold the view that the motive was tax evasion.

They have the power to levy penalty under 270A on account of under-reporting of income which would be equivalent to 50% of the tax avoided by the taxpayer by way of non-filing of return.

The authority can also initiate prosecution under section 276CC with respect to the defaulting taxpayer wherein he may be subjected to a rigorous imprisonment for a term, ranging from minimum 3 months to two years along with fine, depending on the amount of tax evaded, according to them.

In case of any query, please feel free to contact us on this email enquiry@overallaccounting.com