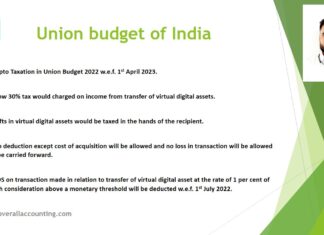

All about upcoming Union Indian Budget 2023

All about upcoming Indian Budget 2023

Etymology and definition:

The word budget comes from the Old French word bougette meaning “small leather purse”, which in turn is a diminutive of the Gaulish bouge for “leather pouch,...

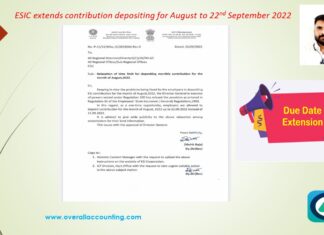

ESIC extends contribution depositing for August to 22nd September 2022

The ESIC has extended the deadline for filing of ESI contribution for August 15th, 2022 to 22nd September, 2022 instead of 15th September

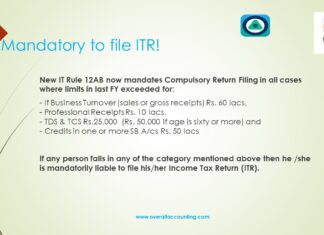

Mandatory to file ITR!

On 21st April Central Board of Direct Tax (CBDT) issued https://www.incometaxindia.gov.in/communications/notification/notification-37-2022.pdf through which Central Government (CG) has introduce Rule 12AB, the Income Tax Rules, 1962 regarding some new conditions for furnishing the Income Tax...

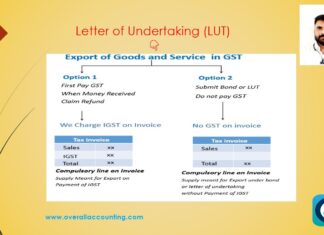

Submit Letter of Undertaking (LUT) for FY 2022-23 by 31.03.2022

What does LUT under GST means?

LUT in GST: Full form/meaning is Letter of Undertaking. It is prescribed to be furnished in the form GST RFD 11 under rule 96 A, whereby the exporter declares...

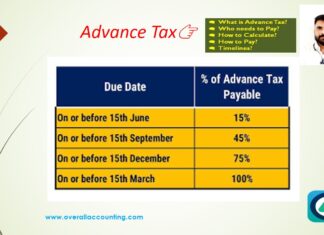

What is Advance Tax? Advance Tax Due Dates, Payments & Calculation

Advance tax means income Tax should be paid in advance instead of lump sum payment at year end. It is also known as pay as you earn tax. These payments have to be made in instalments...

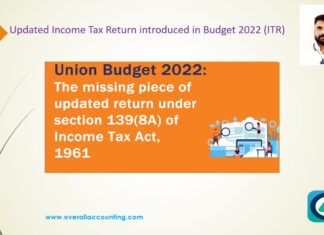

Updated Income Tax Return introduced in Budget 2022 (ITR)

The Government has proposed allowing filing of updated tax returns for up to two years.For Example if you filed a return on December 31, 2021(AY 2021-22), then the assessment year ends on March 31, 2022 and...

E-invoice mandatory if Turnover exceeds ₹20 crores wef 01.04.2022

CBIC made E-invoice under GST mandatory for registered persons having aggregate turnover above ₹20 crore in any of the previous years from 01st April 2022. The existing limit of 50 crores has been reduce...

Income Tax Saving (Deductions on Section 80C , 80D and others)

Deductions Available under Chapter VI of income tax

Chapter VI A of Income Tax Act contains various sub-sections of section 80 that allows an assessee to claim deductions from the gross total income on account of various...

Extension of last date for submitting application for SEIS claim

As per the notification the last date for online SEIS claim application (Service Exporter for FY 2018-19 and 2019-20) has been extended till 28th February 2022