Highlights of Union Budget 2022-23

Please find below Highlights of Union Budget 2022-23.

General

Paperless Budget. Presented on Tab by the FMEconomic Growth to be 9.2% for FY 2022-23Railways to develop projects for MSME small businessesECLGS Scheme extended till March 2023E-Passports...

Union budget of India

All about upcoming Indian Budget 2022

Etymology and definition:

The word budget comes from the Old French word bougette meaning "small leather purse", which in turn is a diminutive of the Gaulish bouge for "leather pouch,...

Notice Under Income Tax

You can get a tax notice for many reasons. These could include not filing income tax return (ITR) on time, calculation errors, not reporting income correctly or even claiming excessive losses.The income tax department...

GST amendment w.e.f. 1st January 2022

We would like to inform you that CBIC has notified the specific provisions of the Finance Act 2021 to be effective from 1st January 2022 vide Notification 39/2021 Central Tax.

We have summarized a few...

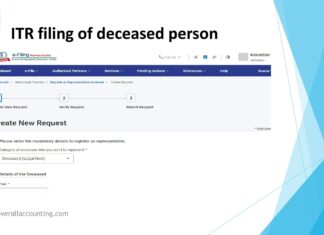

ITR filing of deceased person

ITR filing of deceased person:

In order to file the ITR of the deceased in the capacity of a legal heir, the first step is to register oneself as a legal representative of the deceased...

Form 60 – Submit this if you do not hold a PAN (Individual or...

What is the Form 60? How do I get it?

- Form 60 is a declaration form that an individual can file if one does not have a PAN card.

This can be filed for transactions...

Annual Information Statement (26AS)

The Income Tax Department has announced a new statement – AIS (Annual Information Statement). This was earlier known as Form No. 26AS. Originally, Form No. 26AS contained the details of TDS, TCS & Advance...

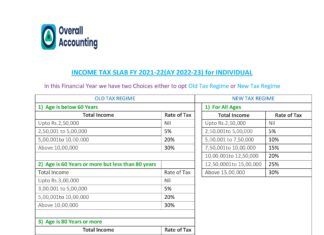

New Income Tax Regime vs Old Tax Regime

For the financial year 2020-2021, every individual has the option either to continue with existing tax rate where exemptions and deductions can be claimed or to opt out for new tax regime where the rates...

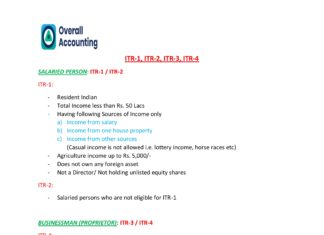

Which ITR applicable to whom for FY 2019-20/AY 2020-21

Form ITR-1 (Sahaj): This form is for Individuals being a Resident (other than not ordinarily resident) having total income upto Rs. 50 lakhs, having Income from Salaries, one house property, other sources (Interest, etc.),...

Income Tax Implications on Freelancers

- Mandatory ITR if Gross Income exceeds INR 2.5 Lakh

- Advance Tax liability if Tax is above INR 10000.

- Every professional service rendered by you is subject to 10% TDS. Like every salaried individual,...