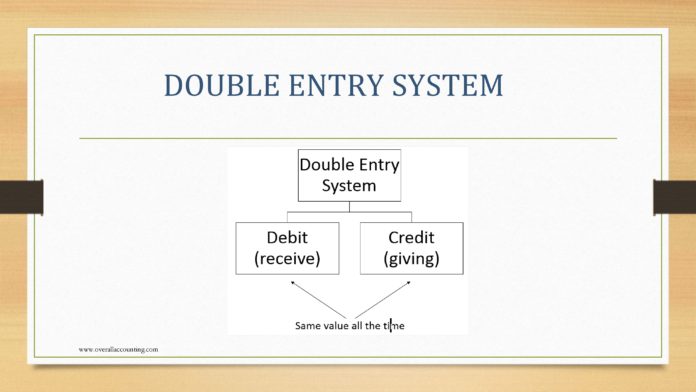

What is the Double-Entry System?

The double-entry system of accounting or bookkeeping means that for every business transaction, amounts must be recorded in a minimum of two accounts. The double-entry system also requires that for all transactions, the amounts entered as debits must be equal to the amounts entered as credits.

For instance, a person enters a transaction of borrowing money from the bank. So, this will increase the assets for cash balance account and simultaneously the liability for loan payable account will also increase.

It’s a fundamental concept encompassing accounting and book-keeping in present times. Every financial transaction has an equal and opposite effect in at least two different accounts. Equation can be: ASSETS = LIABILITIES + EQUITY

Advantages and Disadvantages of Double Entry System

Major advantages and disadvantages of double entry bookkeeping system can be highlighted as follows:

1. Systematic and Scientific Method: – Double entry book-keeping is scientific and systematic system of recording the financial transactions of the business. It is guided by specific rules, principles and techniques.

2. Complete System of Accounting: – Double entry system records both aspects (debit and credit) of each transaction. So, it is a complete system of book keeping.

3. Suitable For Large Companies:- It is suitable for large business companies with large volume of financial transactions and resources.

4. Ensure Arithmetical Accuracy: – Trial balance is prepared under double entry system. Therefore, it ensures arithmetical accuracy of accounting records.

5. To Obtained Profit or Loss: – Profit or loss of a company can be obtained by preparing profit and loss account at the end of the accounting period.

6. To Know the Financial Position: – Balance sheet is prepared at the end of the year. It helps to know the actual financial position of the business.

7. Helps Decision Making: – Double entry system provides financial data, profit, loss and financial position of the business firm. So it helps the management to take appropriate decision for the betterment of business.

8. Comparison of Results: – Financial results of current year can be compared with the result of previous year which helps the management for future planning.

Disadvantages / Limitations / Demerits of Double Entry System

1. Complex System: – Double entry book-keeping is complex system of recording the financial transaction of business. It requires complete accounting knowledge to maintain the books of accounts. It is not easy to understand this method of accounting.

2. Time and Cost Consuming: – It requires more time to record financial transactions in the books of accounts. It requires more money to install and maintain double entry book-keeping in the organization. So, it consumes more time, money and effort as compared to single entry system.

3. Unsuitable for Small Firms: – Double entry system is nor suitable for small business organizations having less number of financial transactions and resources.

NOTE: In case of any query, please feel free to contact me on this email enquiry@overallaccounting.com